About Us

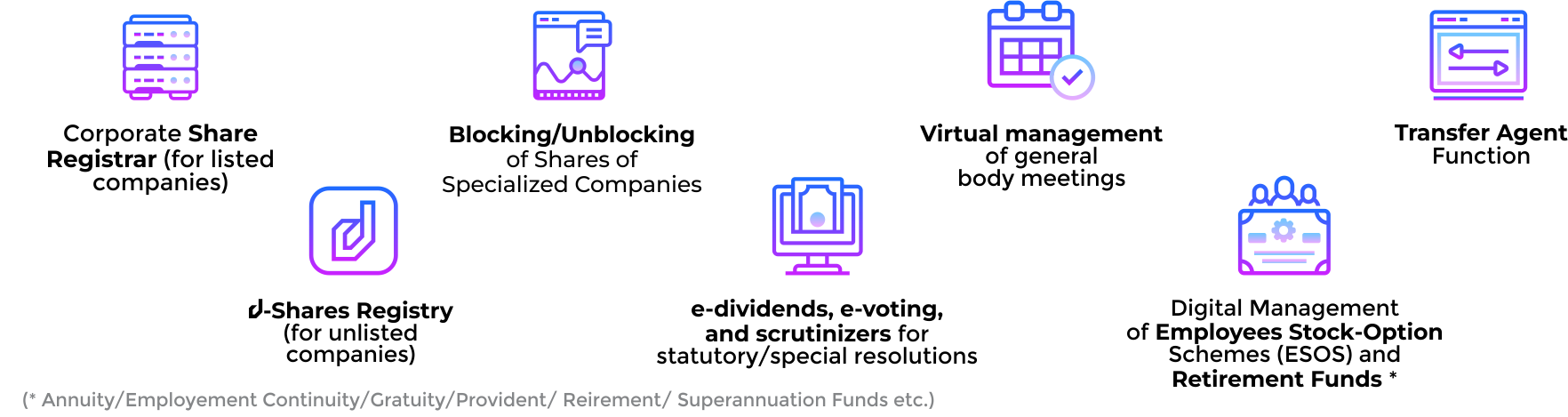

#DCCL is a duly licensed entity by the SECP under the Share Registrars and Balloters Regulations, 2017. #DCCL offers Pakistan's first digitally integrated environment for the life-cycle management of the shareholders’ data as specified in the Companies Act by maintaining a technologically-enabled record of allotments, redemptions, transfers & transmission of shares / securities and e-dividend payments to the share-holders.

#DCCL operates a sophisticated d-Shares Registry Portal for the issuance and management of digitized/dematerialized shares for the companies of all kinds.

Share Registrar Clients

E-Voting Clients

Why Us

Why #DCCL Should Be The Preferred Choice For Corporate Share Registrar Services?

Authentication

• Paper certificates can be lost, misused, stolen and fraudulently transferred.

• Digitized shares are issued in non-repudiable environment, require mutual authentication and digital signatures.

Immutability

• Electronic database of corporate shareholders can not be edited by anyone.

• Digitized shares are secured with PKI, besides being immutable and locked with timestamp.

Investors' Services

• Investors are required to send signed requests, their CNICs and other attachments through letters or email.

• Investors can utilize #DCCL’s App to get their requests processed via two-factor authentication process and validation of digital signatures.

24/7 Availability

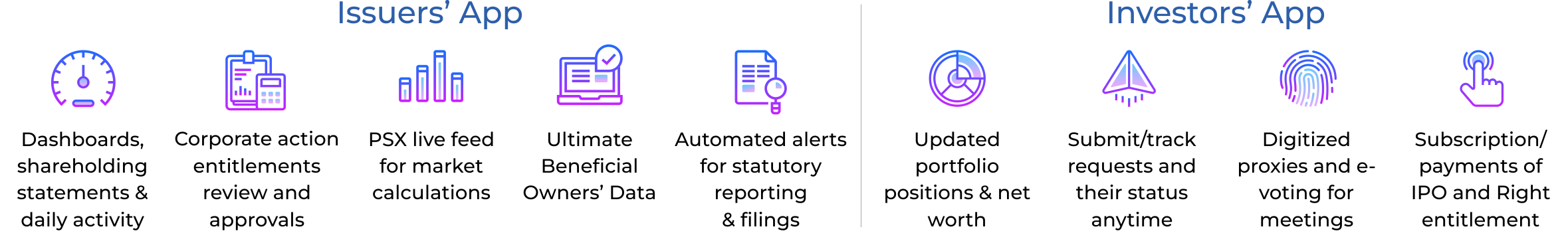

The Issuers' App of #DCCL offers 24/7 access to companies for generating real-time reports/statements, tracking & submission of online action requests.

Companies' Access

• Companies are dependent on the data provided by the Share Registrars, which happens only in response to their requests via letters or emails.

• Provides dedicated Mobile App & Portal to the Companies.

Share Transfers

• Share transfer deeds on stamp papers duly signed by the transferors are needed.

• Shares can be transferred through the Mobile App after authentication/OTP verification.

Duplicate Shares

• Furnishing of indemnity bonds, copies of newspaper adverts are needed for the issuance of duplicate share certificates.

• Digitized shares eliminate the need of the issuance of duplicate certificates.

Rights Shares Subscriptions

• Subscriptions and payments are possible through specified instruments.

• #DCCL enables round the clock subscriptions and online payment confirmations.

Corporate Actions & Entitlements

• Companies have to rely on the Excel files provided by the Corporate Share Registrars for determination of entitlements.

• d -Shares Registry enables the reviewing and approval of the corporate action changes via the Issuers' portal.

IPO Subscription

• Reconciliation of IPO payments & subscriptions processes are quite hectic and time-consuming.

• d-Shares Registry enables self-registration, online subscription & payment confirmations through its Mobile App.

Validity

Shares can be transferred through the Mobile App after validation/OTP verification.

Efficiency

d-Shares Registry enables e-subscriptions to investors by way of self-registration for IPOs, online subscriptions for right shares and instant payment confirmations through its Mobile App.

Compatibility

#DCCL is the only Share Registrar in the country fulfilling the conditions for the emerging regulatory framework, such as; the Companies (Distribution of Dividends) Regulations, 2017, Companies (Postal Ballot) Regulations, 2017 and the Listed Companies (Code of Corporate Governance) Regulations, 2019], which places following additional obligations for various new services of the Share Registrars:

•For services as an “e-Voting Service Provider”, #DCCL is fully compliant with the secured system requirements by having ISO certified Information Security standards, business continuity and disaster recovery arrangements besides also being compliant with the specified functioning protocols for using electronic signatures as defined in the Electronic Transactions Ordinance, 2002.

•For services as a “Paying Agent” for e-dividends, #DCCL's is the only capital market entity having approval to be a “Direct Participant” of the State Bank of Pakistan (SBP)'s Real Time Gross Settlement System (RTGS)/Pakistan Real time Interbank Settlement Mechanism (PRISM), making it eligible to remit payments of cash dividends directly into the designated bank accounts of the entitled shareholders.

•As a “Service Provider” for maintaining the book-entry electronic register of shareholders, #DCCL has the requisite electronic system with internationally recognized certifications ensuring necessary controls and safeguards with advanced cyber security arrangements.

Our Distinctive Services

Key Features of #DCCL's d-Shares Registry

The dedicated d-Shares Registry Portal provides access to our client companies (through designated representatives) for generating real-time reports about the status of share-ownership and monitor changes resulting from any stock options or conversion of shares, warrants and derivatives into the common equity. The Portal also gives complete independence to our client companies to view and input changes in their digitized equity registers and ownership cap-tables for every equity-issuance round.

Pricing

You can now avail our Digital Corporate Registrar Services in just PKR 19,999/- per month.

Frequently Asked Questions

-

1. Why verification of signature on transfer deed is necessary and how can I get my transfer deed verified?

First, the Shareholder is required to verify his/ her signature on the transfer deed, which willpermit him/ her to sell/ transfer the physical shares in favor of another person, or they canhave converted into Book Entry Form as well.

Instructions: Fill all columns on the transfer deed (viz. Name of Company, Name of Shareholder(s), Folio, Certificate & Distinctive numbers, Number of Shares, Mailing Address, CNIC/ NICOP/ NTN, Mobile No. &, etc.) and affix his/ her signature in the column of “Transferor’s/ Seller’s Signature” on the transfer deed duly witnessed by any adult male Pakistani National in witness column (available for Transferor’s/ Seller’s Witness only). Completed transfer deed(s) along with a legible copy of valid CNIC/ NICOP of a shareholder may be submitted at our office or sent via Postal / Courier Service for verification of the signature. Blank Transfer Deed can be downloaded from website at Link

-

2.What are the formalities/procedure for verification of signature on duplicate transfer deed, in case the verified transfer deed has been lost or destroyed, or defaced?

In case of loss/misplacement, the security Shareholder is required to immediately inform Share Registrar regarding loss/misplace of verified transfer deed. Depending on the case to case we may ask few documents/ formalities such as Indemnity Bond, legible copies of valid CNIC/ NICOP of signatories duly attested by the Oath Commissioner/ Notary Public, and fresh/ duplicate transfer deed regarding verification of signature on duplicate transfer deed, etc. You can download a application from our website of DACCL Download Link___________

-

3.What is the procedure for Transfer of Physical Shares into my name?

For transfer of physical shares, the Transferee is is required to submit/send the following documents to Share Registrar through CDC Participant

- First, Share Certificate(s), in the original

- Second, relevant verified transfer deed(s) after having completed the columns of buyer/ purchaser/ transferee on the transfer deed(s) and duly witnessed. The buyer must affix his/ her signature on transfer deed(s) as purchaser/ buyer/ transferee.

- Third, legible copies of valid CNIC/ NICOP of shareholder/ transferor/ Seller, purchaser/ buyer/ transferee, and witnessing person (Male Witness).

- Fourth, stamp/ Transfer duty should be paid by the applicant in the shape of share transfer stamps i.e. @ 1.5% of the face value of the shares e.g. transfer stamps of Rs.75/- are required for transfer of 500 shares to be affixed on the reverse side of transfer-deed.

Note:The name of the shareholder must be matched with his/ her CNIC/ NICOP.

Condition: If the applicant is a non-resident (overseas) and desires to transfer the physical shares in his/ her name they should also submit the Proceeds-Realization-Certificate for the number of shares and transfer stamp dutyremitted to Pakistan along with the above-mentioned documents as well.

Condition: If the applicant is a corporate body, they should be submitted the above-mentioned documents together with attested copies of Memorandum & Articles of Association, Board Resolution or Power of Attorney & List of authorized signatories as well. -

4.How do I convert my physical shares into electronic shares?

In the procedure of converting physical shares into electronic shares, the security holder is required to get the shares deposited into the Central Depository System (CDS) of Central Depository Company of Pakistan Limited (CDC), by following the procedure below.

- Contact the Stock Member/ Broker/ CDC Participant/ CDC Investor Account Service for the opening of the CDS Account. The Shareholder will have to submit original share certificate(s), relevant verified transfer deed(s), legible copy of valid CNIC/ NICOP, and Security Deposit Form duly signed by the Account-holder/ Shareholder to the CDC Participant. The CDC participant will initiate deposit requests in CDS on behalf of the shareholders.

- After the above initiative the stamp/ Transfer duty should be paid by the shareholder in the shape of share transfer stamps i.e. @ 0.15% of the face value of the shares e.g. transfer stamps of Rs.15/- are required for deposit of 1,000 shares to be affixed on the reverse side of transfer deed as well.

- Furthermore, the CDC Participant will send the above-mentioned documents to the relevant Share Registrar for the next step is approval into CDS. In this continuation with the above-mentioned documents, the Share Registrar will review/ verify the same and approve the CDS within 10 days.

Note: Furthermore, if any discrepancy or discrepancies in the documents raise, the transaction ID will be rejected immediate. Further, the name of the shareholder must be matched with his/ her CNIC/ NICOP and CDS Account.

-

5.Is it possible to revert the electronic shares in the book-entry form to physical shares?

If the Shareholder is intended to get convert the electronic share into physical shares for any reason. The Shareholder shall contact relevant CDC participants for withdrawal of shares from his/ her CDS Account.

- On behalf of receipt of Security Withdrawal Form (SWF) duly filled and signed by principle Shareholder & Joint-holder (if any) along with legible copies of his/ her valid CNIC/ NICOP by the CDC Participant, they initiate withdrawal request in CDS on behalf of the Security holder.

- further, the stamp/ Transfer duty should be paid by the shareholder(s) in the shape of share transfer stamps i.e. @ 1.5% of the face value of the shares for example transfer stamps of Rs.150/- are required for Withdrawal of 1,000 shares to be affixed on the reverse side of SWF.

- The CDC Participant sends the above-mentioned documents together with the CDS withdrawal request (printout obtained after initiating withdrawal request into CDS) to Share Registrar.

- Upon receiving of above-mentioned documents, the Share Registrar will review/verify the documents and will accept the withdrawal request into CDS within 5-days and physical share certificate(s) deliver/ dispatch to Shareholder within 15-days.

Note: If any discrepancy or discrepancies in the documentsare found, the transaction ID will be rejected immediately.

-

6.How can I get the duplicate share certificate if lost the original?

- If the share certificate(s) is lost or misplaced the original certificate, the shareholder must immediately report to the Share Registrar through a letter duly signed by the shareholder along with a legible copy of his/ her valid CNIC/ NICOP.

- The Share Registrar will ask to the Shareholder i through letter/e-mail for submission of necessary documents such as publication in Newspapers, undertaking/ Indemnity, legible copies of valid CNIC/ NICOP of shareholder, guarantor, and witnesses (who have signed on the Indemnity), ensure that the Indemnity Bond & copies of CNIC/ NICOP attested by the Notary Public/ Oath Commissioner.

- Overseas Pakistani (Non-resident), shall provide the undertaking/ Indemnity on a plain paper along with copies of CNIC/ NICOP/ Passport of shareholder, guarantor and their witnesses (who have signed on undertaking/Indemnity), the security holder must ensure that all the documents are attested/ endorsed by the Embassy of Pakistan or Consulate General of Pakistan where the security holder is living.

- • Upon submission of the required documents from the member/ shareholder, the duplicate share certificates will be issued within 30 days.

- Obligation :In respect of issuance of new share certificate in respect of destroyed or defaced or mutilated certificate, the shareholder should surrender the same to the Share Registrar immediately.

Note: The application letter for this purpose can be downloaded from our website at link.

-

7.How can I change my data/information in Company’s record?

- • The Shareholder can change his/ her registered personal data/ information (including CNIC number, NTN, IBAN/Bank details, Mobile/ Landline No., mailings address, Email, Zakat Status &, etc.) in the company’s record.

- • Immediate basis the Shareholder must communicate to the Share Registrar (for physical shares) or CDC participants (for shares in Book Entry Form) through a letter duly signed as per the specimen signature registered in Company’s record along with a legible copy of his/ her valid CNIC/ NICOP.

- • In case of updating of Zakat status as Muslim Zakat non-payable, notarized copy of Zakat Declaration Form CZ-50 must be sent to the Share Registrar (for physical shares) and CDC participants (for shares in Book Entry Form)

Note: Letter can be downloaded from our website at link _________________

-

8.How can a Shareholder get his / her cash dividend or bonus shares?

Information for Cash Dividend:

- The general procedure for listed companies in PSX can make payment of dividends through electronic mode in the designated bank account of the entitled security holder, who have updated their IBAN (24 digits) and bank details in the register of members with Share Registrar of the Company or their relevant CDC participant.

- Those Shareholders who have not updated their IBAN (24 digits) and bank details, are instructed to immediately provide the information and the dividend will pay directly electronically to the bank account holder of the shareholder.

- The Shareholders who holds shares in physical form are requested to submit their IBAN (24 digits) and bank details to Share Registrar if not yet submitted.

- The Shareholdesr who holds shares in the book-entry form on Central Depository System (CDS) are requested to submit their IBAN (24 digits) and bank details to their relevant CDC participant and get confirmation accordingly.

- I The Share-holders who holds shares in physical form, the bonus share certificates will be dispatched to them at their registered mailing address through registered post/ courier accordingly.

- The Shareholders who holds shares in book-entry form into Central Depository System (CDS), the bonus shares will be directly credited into respective CDS account maintained with CDC participant accordingly.

Note:Letter can be downloaded from the website at link __________________

Information for Bonus Shares:

-

9.What I do in case of non-receipt of cash dividend/bonus shares in due course of time?

- • If theshareholder has not received any dividend warrant or bonus share certificates or lost/misplaced the same, the shareholder is required to immediately report to the Share Registrar through a letter duly signed by the shareholder along with a legible copy of his/ her valid CNIC/ NICOP.

- • The Share Registrar will check dividend warrants or bonus shares certificates in Share Registrar custody, and if found undelivered from the postal authority, the bonus shares certificate will be re-dispatched to the shareholder and subsequently dividend warrants will be forwarded to the issuer/ company for revalidation.

- • If the dividend warrants or bonus shares certificate(s) has/have not been returned to the Share Registrar as undelivered by the postal authority, the same will be treated lost/misplaced In transit.

- • The Share Registrar may ask the shareholder through letter/e-mail for submission of necessary formalities such as publication in Newspapers, undertaking/ Indemnity, legible copies of valid CNIC/ NICOP of shareholder, guarantor, and witnesses (who have signed on the Indemnity), duallyconfirmed that the Indemnity Bond & copies of CNIC/ NICOP attested by the Notary Public/ Oath Commissioner.

- • overseas (Non-resident) Pakistani shareholder shall provide the undertaking/ Indemnity on plain paper along with copies CNIC/ NICOP/ Passport of shareholder, guarantor and their witnesses (who have signed on undertaking/Indemnity), dually confirmed that all the documents attested/ endorsed by the Embassy of Pakistan or Consulate General of Pakistan where the shareholder is living.

- • submission of the required documents from the member/ shareholder, the duplicate Shares/Dividend warrants will be issued and delivered/dispatched to Shareholder accordingly.

Note: letter for the purpose can be downloaded from the our website at link ___________ .

-

10.How can we transfer/transmission of shares and dividends in favor of legal heirs of the deceased shareholder?

In the event of death of Shareholder, The legal heirs or representative of the deceased Shareholder immediately send the application to the Share Registrar duly supported by Notarized copies of NIC/ CNIC/ NICOP and Death Certificate of deceased shareholder for obtaining the current status of Shareholding and procedure/ formalities for transmission of shares and dividends into the name of legal heir(s).

After submission of documents, the share Registrar shall communicate the status of current Shareholding of deceased shareholder and formalities to be completed for transmission of shares and dividends (if any) in favor of legal heirs/ successors which includes as follows.

- Photocopy of Court Order and Succession Certificate duly attested by the issuer.

- Original share certificates and un-paid dividend warrants (if any) in the name of the deceased shareholders.

- Notarized photocopies of CNIC/ NICOP of all legal heir/ successor.

LLetter of Requests duly filled and signed by all legal heir/ successor and shall Notarized, legible copy of valid CNIC/ NICOP of witnesses.

After submission of documents, in an appropriate manner to the Share Registrar, the Share Certificate(s) and dividends (if any) of deceased shareholders will be transmitted in favor of legal heir(s)/ successor(s). In case deceased shareholders hold shares in the book-entry form on Central Depository System (CDS), the legal heirs or representative will immediately send the application to the relevant CDC participant.

Note: Letter can be downloaded from our website at link _______________

-

11.How can I get my Right Share Certificate?

- within 30 days after the last date of payment for subscription of Right Shares, the Right Share Certificate will be ready for delivery/ dispatch.

- To receive the physical Right Share Certificate(s),, the Shareholder shall send the original paid right letter along with a legible copy of his/ her valid CNIC/NICOP to the Share Registrar for exchange with Right Certificate.

- Furthermore, submission of the original paid right letter along with a legible copy of valid CNIC/ NICOP to the Share Registrar, the Right Share Certificate will be delivered/ dispatched to the Shareholder.

- In respect of shares held in the book-entry form on CDS, the right shares are directly credited into the respective CDS account within the stipulated time.

- Letter is available on our web-link: _________________